BBA in Banking and Fintech – Build a Successful Career in the Fastest Growing Sector

The banking and finance sector is one of the dream destinations for several business administration aspirants. This domain demands individuals with specific skills and expertise. Hence, focused and strategic training remains in order to enter the industry. Owing to the growing demand for technically and academically outstanding resources for different posts in banking and finance, a BBA in Banking and Fintech course is gaining popularity.

BBA Banking and Fintech is an undergraduate Commerce programme that deals with the study of fundamentals and concepts used and practised in the banking and finance sectors. The course covers the study of the fundamental concepts of management with specialised training in BBA Banking and Fintech subjects, including International Banking and Finance, Treasury Operations, Investment Banking, Risk Management, Project & Infrastructure, etc. BBA in Banking & Fintech eligibility criteria vary from one institution to another.

Moreover, BBA Banking & Fintech graduates have numerous opportunities waiting around because of the diverse skill set that the graduates possess. The best career in banking and finance lies in industries including financial consultancies, financial institutions and banks. To be more specific, you can get into areas like merchant banking, international finance, investment and consumer banking, corporate finance and institutional finance. After that, once you build up your work experience, you can serve on government committees and give your input to policy-making issues.

Since BBA Banking & Finance graduates are experts in Finances, Insurance, Banking, Accounting, Fund management etc., it makes them ideal professionals for the best careers in banking and fintech. Numerous organisations are rising from the ground and need an individual who can manage and administrate the organisation perfectly, opening up a variety of opportunities in the domain.

- Credit Managers

These professionals are experts in the credit-granting process of an organisation. Under their profile comes perfect utilisation of organisation sales, management and implementation of credit policy for reducing the organisation’s losses. - Insurance Managers

Insurance Managers are responsible for managing and overseeing the investment process and policies. They also locate the lacking areas to work on to boost productivity. - Cash Managers

This is an important job role after BBA in Banking & Fintech. These professionals perform a beneficial role in a company which can be vital for the company because they collect and manage the cash flow. - Investment Bankers

Investment Bankers are investment experts who integrate financial services industry expertise, analytical prowess, and effective persuasive communication skills to support institutional clients in capital raising and mergers and acquisitions. - Financial Analysts

These professionals work in banks, pension funds, insurance companies, or working with businesses. Their goal is to lead their business clients in expanding their money to make profits.

Secure the Remunerative Opportunities with BBA Banking & Fintech Programme at JK Lakshmipat University (JKLU)

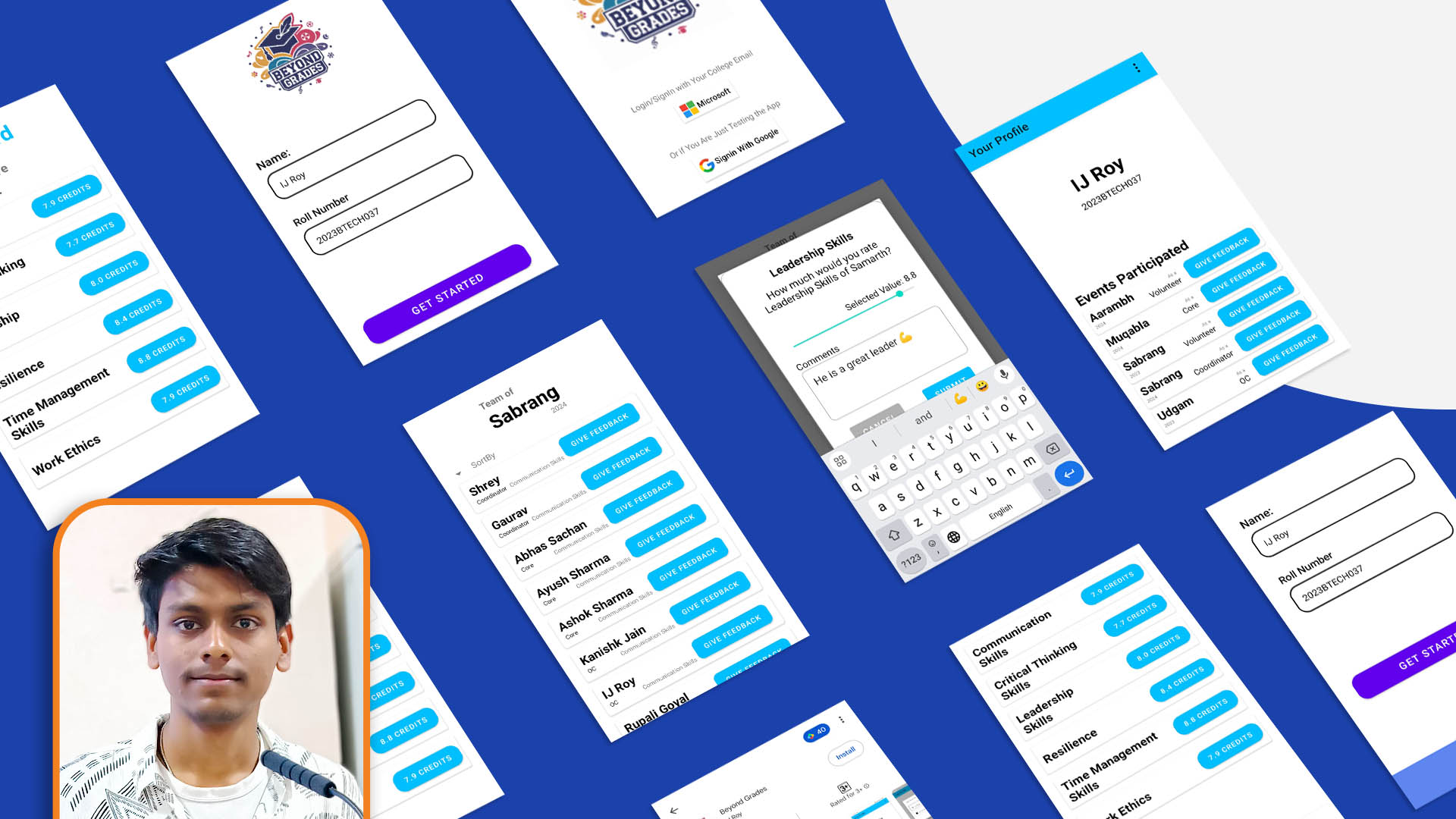

The specialised BBA programme in Banking & Fintech offered by JK Lakshmipat University (JKLU), Jaipur, is the perfect launch pad for students who wish to work at the intersection of finance and technology. The programme builds foundational capability in core management fields of marketing, finance, economics, operations and HR, along with exposure to digital banking and finance operations, digital customer journeys, technology frameworks and key stacks in the financial sector.

Key Highlights of the BBA Banking & Fintech Programme:

- Project-driven Internships

- Teaching integrated with practice

- Faculty from IIMs, industry and global institutions around the world

- Hands-on experience in Fintech and its subdomains and sectors

- Multidisciplinary curriculum with exposure to critical life skills like communication, collaboration, and critical thinking

- Expert sessions by industry experts

- Learning with real-life case studies, field projects, discussions, team projects, role-plays, and simulation lab

Additionally, BBA Banking & Fintech students at JKLU get the benefit of an internship in the final semester and existing partnerships with renowned companies for potential employment and with startups in emerging areas of Web 3.0, Blockchain, Mobile Banking, Investment apps, etc.

BBA in Banking & Fintech – Your Gateway to a Thriving Career

The finance department is the backbone of an organisation because they handle and maintain budgets, losses and profits. Therefore, most companies hire professionals who can handle accounts work efficiently. As a result, there are numerous job opportunities in India for BBA Finance and Banking graduates in both government and private sectors. As a Fresher, individuals can expect to earn around 4.5 Lakhs in India, and after 5-10 years of experience in the field, they can reach about 10 Lakhs. In addition, the salary after BBA in Banking and Fintech in India is better than in other domains, providing you with good living standards.

Recent blogs:

Browse university events:

-

The Importance of Mentorship

January 30, 2025 -

Workshop on Mentoring

January 30, 2025 -

CAT Coaching on Campus in Collaboration with iQuanta

January 30, 2025 -

Career Opportunities with RBI

January 30, 2025

Read university news:

-

Aarambh 2022 – Orientation Program for Batch of 2022

August 1, 2022 -

India Today Rankings 2022

July 21, 2022